Emerging Business Insights

2026 Employer Outlook: Tax-Advantaged Plans Offer Increased Savings Opportunities

JANUARY 6, 2026

While retirement benefits can help attract and retain executive staff, these highly compensated employees (HCEs) often face limits on how much they can contribute to their retirement accounts.

For many smaller employers with traditional, non-safe-harbor retirement plans, nondiscrimination testing can make it more challenging for business owners and executives to save effectively. To help ensure that retirement benefits don’t favor HCEs over others, plans must complete this annual testing, which can include actual deferral percentage (ADP) and actual contribution percentage (ACP), among others.

Approximately 30% of small businesses subject to ADP and ACP testing fail one or both tests, which can result in costly corrective actions. To maintain the plan’s qualified status and tax advantages, employers most commonly remedy this by refunding a portion of contributions made by the HCEs. Adding a health savings account (HSA) with a qualified high-deductible health plan (QHDHP) can provide these key employees with another way to maximize savings.

Increase Retirement Savings Tax-Free

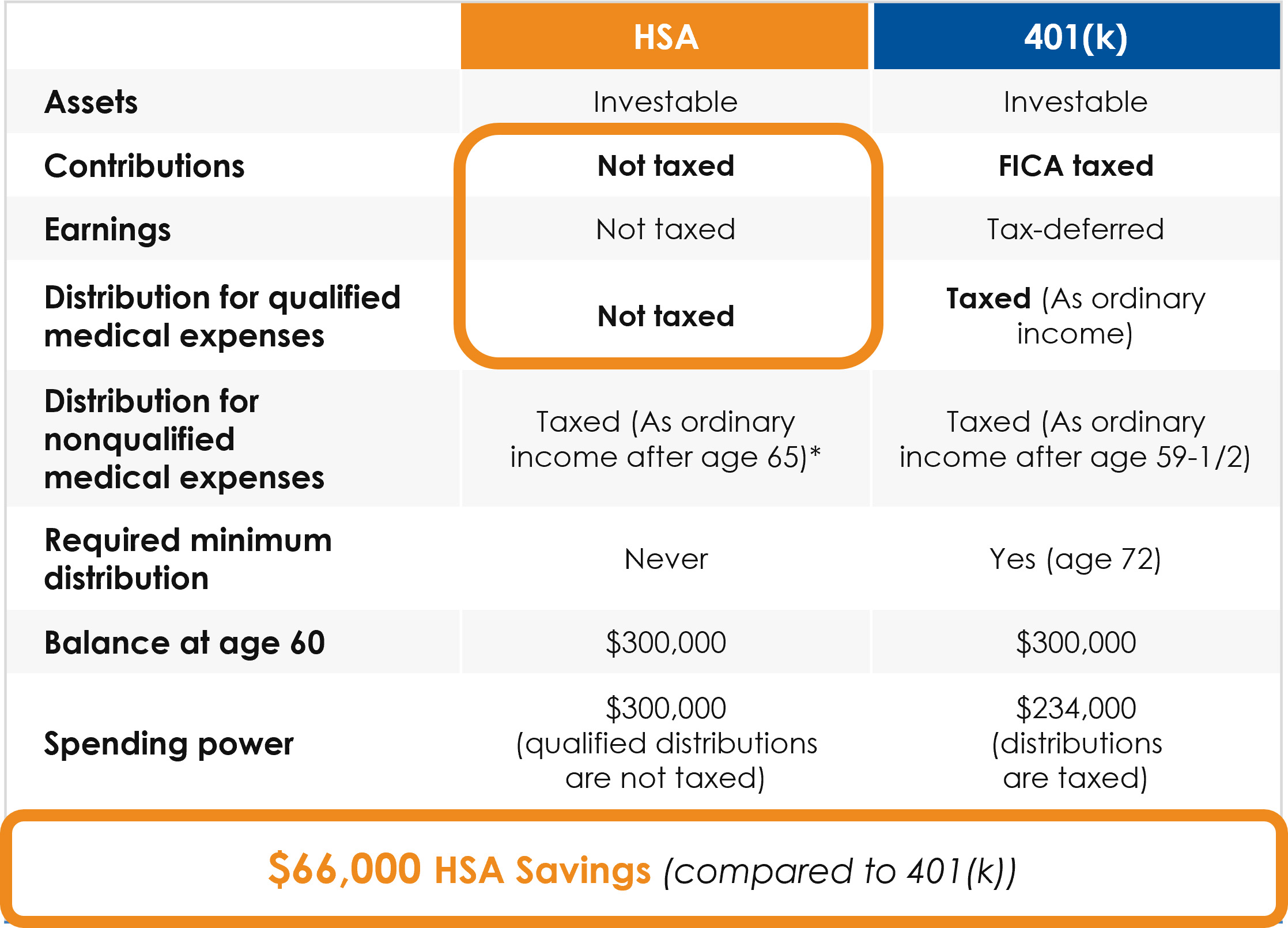

HSAs offer several tax advantages that can help employees save more efficiently:

- Contributions are tax-free, up to the annual federal limit.

- Funds used for qualified medical expenses are not taxable, and there is no time limit for reimbursement submissions.

- Account balances can grow over time, with no tax on interest or investment growth.1

After age 65, HSA account holders can use these funds for non-medical expenses.2 This can significantly boost retirement readiness for employees at every level within the company.

Considerations for Implementing HSAs

Employers may only offer an HSA with a QHDHP. Plan members enrolled in a non-qualifying plan would not be eligible for an HSA. Employers may allow for pre-tax salary reductions for HSA contributions through a Section 125 cafeteria plan, subject to nondiscrimination testing. Keep in mind, only employees may participate in a Section 125 cafeteria plan, including making pre-tax HSA contributions. Self-employed individuals — such as sole proprietors, partners, members of an LLC, and S-Corp shareholders with more than 2% ownership — are not considered employees and therefore cannot make pre-tax salary reduction elections to an HSA. However, these individuals can make an after-tax HSA contribution and take an above-the-line deduction on their annual tax return.

|

HSAs can help cover the higher out-of-pocket medical expenses that come with high-deductible plans. The triple tax advantage makes the HSA one of the most powerful tools for retirement savings. |

Employer Contributions Can Help Reduce FICA Tax Burden

Employer contributions are not required, but they can help reduce employer tax liability under the Federal Insurance Contributions Act (FICA). Employers currently pay 7.65% in FICA taxes on employee compensation and certain benefit contributions. However, employer contributions to an HSA — including pre-tax salary reductions made by an employee — are not subject to FICA, lowering the overall taxable amount. Offering employer contributions can also increase participation, further reducing the FICA tax burden.

Companies should be aware that HSA contributions made through a Section 125 plan should be included in annual nondiscrimination testing. Contributions that favor HCEs or key employees increase the potential for discrimination testing failures. Special rules apply to HSA contributions on behalf of self-employed individuals (see IRS Notice 2005-8 and Publication 969). Employers should discuss appropriate tax treatment with their tax advisors.

How USI Can Help

Employers can strengthen their employee benefits by offering competitive retirement and tax-advantaged plans. The retirement experts at USI Insurance Services can assist with:

Plan design and benchmarking — We analyze plans using our proprietary benchmarking to optimize plan design, increase employee participation, and improve pricing, technology, investments, and service.

Investment advisory — Our independent, high-level investment strategy and consulting services can help employers meet investment objectives and fulfill fiduciary obligations.

Compliance — We evaluate the potential impact of legislative and regulatory changes while helping to simplify compliance issues and mitigate risk.

Employee education and engagement — The tools and resources we offer are designed to increase engagement and help employees save more.

For employers without retirement benefits, USI can help design and implement a 401(k) or other solutions to give employees the benefits they value and improve retirement readiness.

Contact your local USI representative at ebsolutions@usi.com to learn more about these and other strategies designed to optimize benefits spending for your company.

1 These statements reflect the federal tax treatment of HSA contributions and earnings. Some state income tax laws, such as those in California and New Jersey, may treat HSA contributions differently. Discuss tax implications with your tax advisor.

2 After age 65, HSA account holders can use these funds for non-medical expenses, taxed as ordinary income, similar to assets in a 401(k) account.

SUBSCRIBE

Get USI insights delivered to your inbox monthly.